China promotes further opening in panda bond market

China has announced improved fund management rules for panda bond issuance as part of the efforts to promote further opening-up in its bond market.

The People's Bank of China and the State Administration of Foreign Exchange have jointly released the new regulations, which will come into effect on Jan. 1, 2023, to facilitate the financing of overseas institutions in the country's bond market.

Separate rules for the interbank market and the exchange-traded market, concerning fund registration, fund remittances, and the opening of accounts, will be unified, according to the official document.

Overseas institutions will be allowed to conduct foreign exchange derivative transactions to manage exchange rate risks, and funds raised through bond issuance can be kept in China or remitted overseas.

Panda bonds are yuan-denominated debts sold by overseas issuers in China. Launched in 2005, the market has witnessed booming growth since 2015 and has become a significant financing channel for overseas institutions and enterprises.

Analysts said the latest move will further improve the framework of the panda bond market and came as another step forward for the institutional opening-up of the bond market.

Feng Lin, a researcher of Golden Credit Rating, said the market regulation will be more transparent and the bond issuance will be more convenient, which will be conducive for the market to continue growth and attract more diverse issuers.

The authorities have continuously improved the policy support, relevant systems, and detailed rules for the market and gradually cleared obstacles and technical problems in the way of its development, said Bruce Pang, the Greater China chief economist of real estate and investment management services firm JLL.

A pilot program was launched earlier this year by the National Association of Financial Market Institutional Investors to streamline the panda bond registration and issuance mechanism. The issuer base for universal registration was expanded, and repetitive disclosure was reduced.

With continued improvements to the market, experts believe the panda bond issuance still has great potential for further growth, with green bonds as a major driver.

In late November, Mercedes-Benz issued its first green panda bond worth 500 million yuan (about 71 million U.S. dollars), with a term of two years and a coupon rate of 2.9 percent. The funds will be used for financing new customer leasing contracts with battery electric vehicles. It is the German carmaker's first green bond outside of the European market.

In the first nine months of this year, approximately 75.4 billion yuan of such bonds were issued in the country, up 8.7 percent from a year ago. At the end of September, the outstanding bonds amounted to 167.78 billion yuan, up by 28.86 billion yuan from the end of 2021.

最新热点

最新热点

-

遇见广州,解锁未来都市的N种模样 | 粤见APEC

-

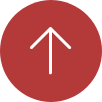

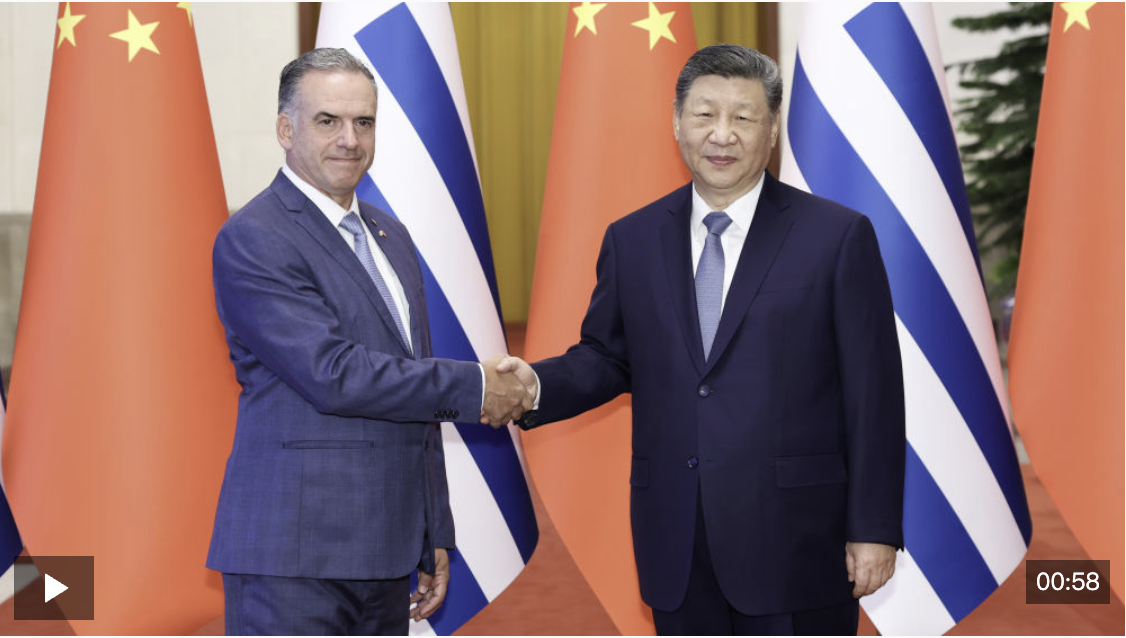

独家视频丨习近平同乌拉圭总统奥尔西举行会谈

-

独家视频丨习近平同乌拉圭总统会谈:持续深化全面战略伙伴关系 加强全球南方团结协作

独家视频丨习近平同乌拉圭总统会谈:持续深化全面战略伙伴关系 加强全球南方团结协作

最新热点2月3日上午,国家主席习近平在北京人民大会堂同来华进行国事访问的乌拉圭总统奥尔西举行会谈。 习近平指出,中国有句古语,“相知无远近,万...

-

独家视频丨习近平同乌拉圭总统会谈:你是中国人民的好朋友 也是今年首位访华的拉美国家元首

独家视频丨习近平同乌拉圭总统会谈:你是中国人民的好朋友 也是今年首位访华的拉美国家元首

最新热点2月3日上午,国家主席习近平在北京人民大会堂同来华进行国事访问的乌拉圭总统奥尔西举行会谈。 习近平指出,38年前的今天,中乌实现建交。38年来,无...

-

广东这个千年古县,韩愈来了都说好

北京将打造现代化首都都市圈 壮大先进制造业集群

北京将打造现代化首都都市圈 壮大先进制造业集群

中国“个性年货”俏销 多元供给精准对接需求

中国“个性年货”俏销 多元供给精准对接需求

中国成功发射卫星互联网低轨18组卫星

中国成功发射卫星互联网低轨18组卫星